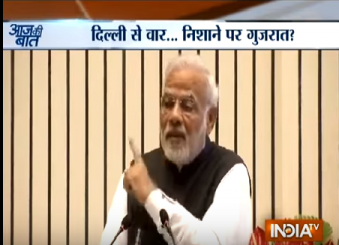

On Wednesday, Prime Minister Narendra Modi, while addressing a FICCI meeting, launched an attack on the UPA government over bad loans, calling it the “biggest scam” of the previous government and blamed it for putting pressure on banks to lend to select corporates. Modi alleged, banks were pressurized to give loans to a select few industrialists, and this scam was bigger than the coal and 2G scams.

On Wednesday, Prime Minister Narendra Modi, while addressing a FICCI meeting, launched an attack on the UPA government over bad loans, calling it the “biggest scam” of the previous government and blamed it for putting pressure on banks to lend to select corporates. Modi alleged, banks were pressurized to give loans to a select few industrialists, and this scam was bigger than the coal and 2G scams.

The Prime Minister also scotched rumours being spread about bank deposits because of the proposed FRDI (Financial Resolution and Deposit Insurance) bill, which will be brought before Parliament in the forthcoming winter session. Indian banks are struggling with nearly Rs 7 lakh crore of non-performing loans and Modi said, the non-performing assets of banks were the biggest liability handed down by economists sitting in the previous regime, because of which banks are unable to lend money to create new jobs.

Modi explained that the FRDI bill, presently before the select committee of Parliament, is aimed at quick resolution of non-performing assets of banks. He assured depositors that their money was safe in banks and there was no need to believe rumours that are being spread about the bill. Two days ago, Finance Minister Arun Jaitley had also explained that the FRDI bill was meant to make bank deposits more secure, and if the banks ever fail, the bill was meant to provide more compensation than the present limit of Rs 1 lakh that is legally permissible. Congress leaders like Anand Sharma have been posing questions based on such rumours, and one should be aware about the sources which are trying to create unnecessary panic among bank depositors.

Click Here for the Video